Saving money and budgeting are essential skills that everyone should master to achieve financial stability and security. In today’s world, where the cost of living is constantly increasing, it’s becoming more challenging to manage expenses and save money. However, with the right strategies and mindset, anyone can learn how to save money and budget effectively. In this article, we will discuss the best tips for saving money and budgeting:

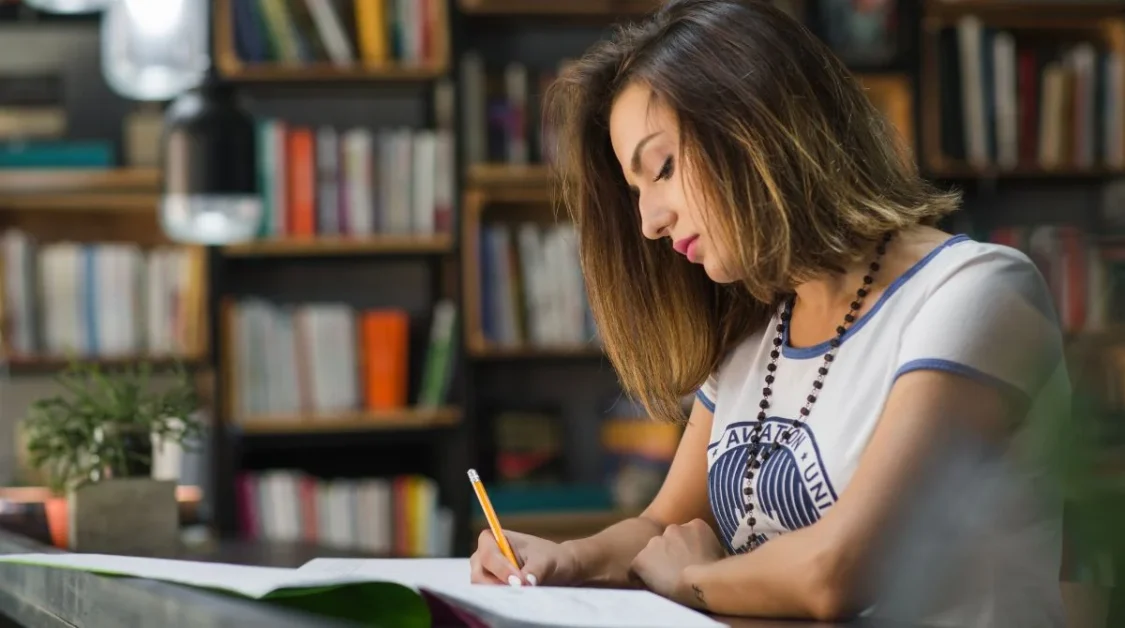

Understand Your Expenses

The first step to effective budgeting and saving money is to understand your expenses. It’s crucial to have a clear picture of your income and expenditures to determine where your money goes each month. You can create a budget worksheet or use a budgeting app to track your expenses and income. Divide your expenses into different categories such as rent, utilities, food, transportation, and entertainment. This will help you identify areas where you can cut back and save money.

Set Financial Goals

Setting financial goals is another crucial step in saving money and budgeting. Identify your short-term and long-term financial goals such as paying off debt, saving for a down payment on a house, or planning for retirement. Having clear financial goals will motivate you to stick to your budget and save more money.

Prioritize Saving

One of the most effective ways to save money is to make it a priority. Aim to save at least 10% to 20% of your income each month. You can set up automatic transfers from your checking account to a savings account to make saving more manageable. Another way to save money is to reduce unnecessary expenses such as eating out, subscription services, or buying brand name products. Instead, look for ways to cut back and save more money each month.

Increase Your Income

Another way to save money and reach your financial goals is to increase your income. There are many ways to earn extra money, such as taking on a side hustle, freelancing, or selling items you no longer need. You can also explore online opportunities such as affiliate marketing or YouTube monetization. Check out ways to make money online to learn more about different income streams.

Use Technology to Your Advantage

Technology can be a powerful tool in saving money and budgeting. There are many budgeting apps available that can help you track your expenses, set financial goals, and save money. For example, you can use the Apple Pay Later feature to spread out payments for purchases over time without accruing interest charges. Check out Apple Pay Later to learn more about this feature. You can also use social media to your advantage by promoting affiliate products and earning a commission. Check out Amazon affiliate program to learn more about affiliate marketing.

Be Consistent and Patient

Saving money and budgeting is a long-term process that requires consistency and patience. Don’t expect to see results overnight. Instead, focus on making small changes that will add up over time. Stick to your budget and financial goals, and don’t get discouraged if you encounter setbacks along the way. With perseverance and dedication, you can achieve financial stability and security.

In conclusion, saving money and budgeting are essential skills that anyone can learn with the right mindset and strategies. By understanding your expenses, setting financial goals, prioritizing saving, increasing your income, using technology to your advantage, and being consistent and patient, you can achieve financial stability and security. Check out social media to learn more about how to promote products on social media.